Walmart vs. Amazon: Differences , Profitability and Why We Shouldn't Ignore

Walmart vs. Amazon: Differences , Profitability and Why We Shouldn't Ignore

Walmart vs. Amazon: Differences , Profitability and Why We Shouldn't Ignore

Walmart vs. Amazon: Differences , Profitability and Why We Shouldn't Ignore

Table of Content

Title

Title

Kamlesh Deora

Kamlesh Deora

Kamlesh Deora

Kamlesh Deora

Kamlesh Deora

Web Design

Web Design

Web Design

Web Design

Web Design

10 Min Read

12 Min

12 Min

10 Min Read

10 Min Read

Nov 25, 2025

11/25/25

11/25/25

Nov 25, 2025

Nov 25, 2025

Selling online today means choosing the right marketplace as much as choosing the right product. For many sellers, the decision often comes down to two giants: Amazon and Walmart. Both platforms offer massive reach, established trust, and powerful infrastructure—but they operate very differently and suit different types of businesses.

Amazon is known for its global scale, advanced fulfillment network, and intense competition, while Walmart is growing fast with a more selective marketplace, lower competition in many categories, and strong omnichannel presence. Choosing the wrong platform can impact your margins, visibility, and long-term growth.

In this blog, we’ll break down the key differences between Amazon and Walmart from a seller’s perspective, including fees, competition, fulfillment options, audience behavior, and growth potential. By the end, you’ll have a clear understanding of which marketplace aligns best with your business goals and selling strategy.

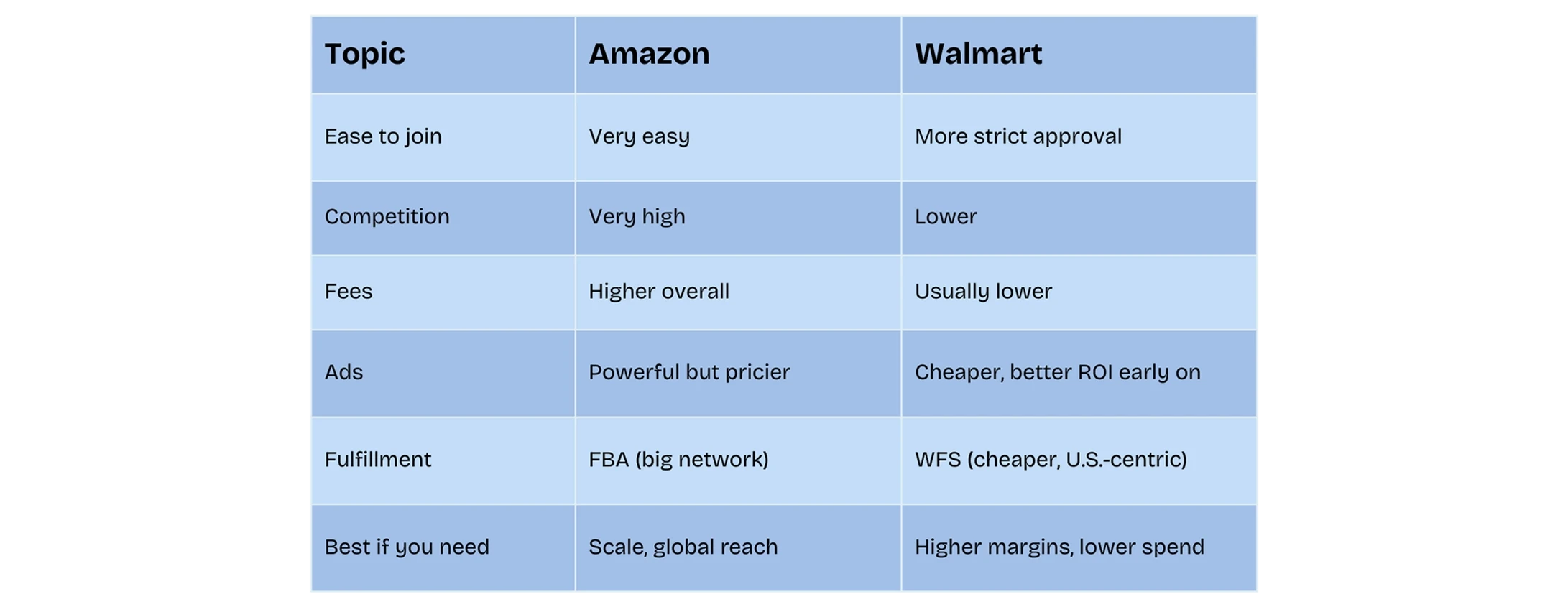

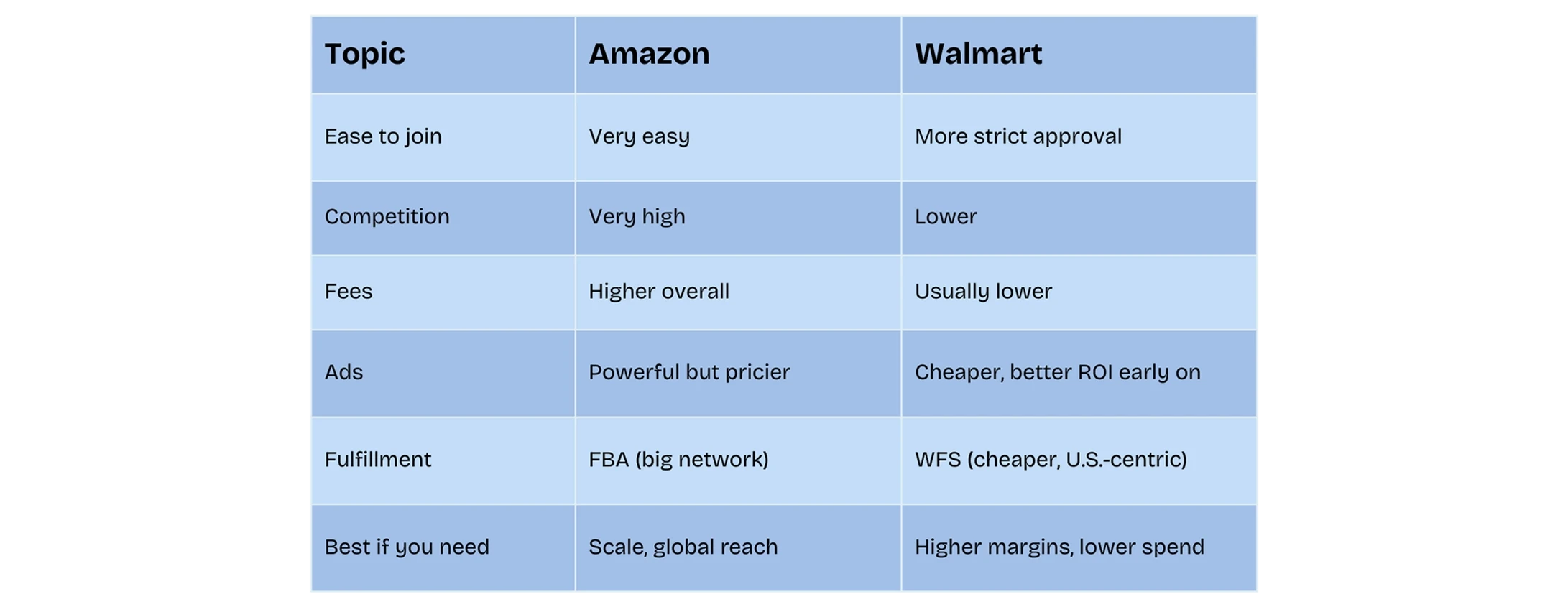

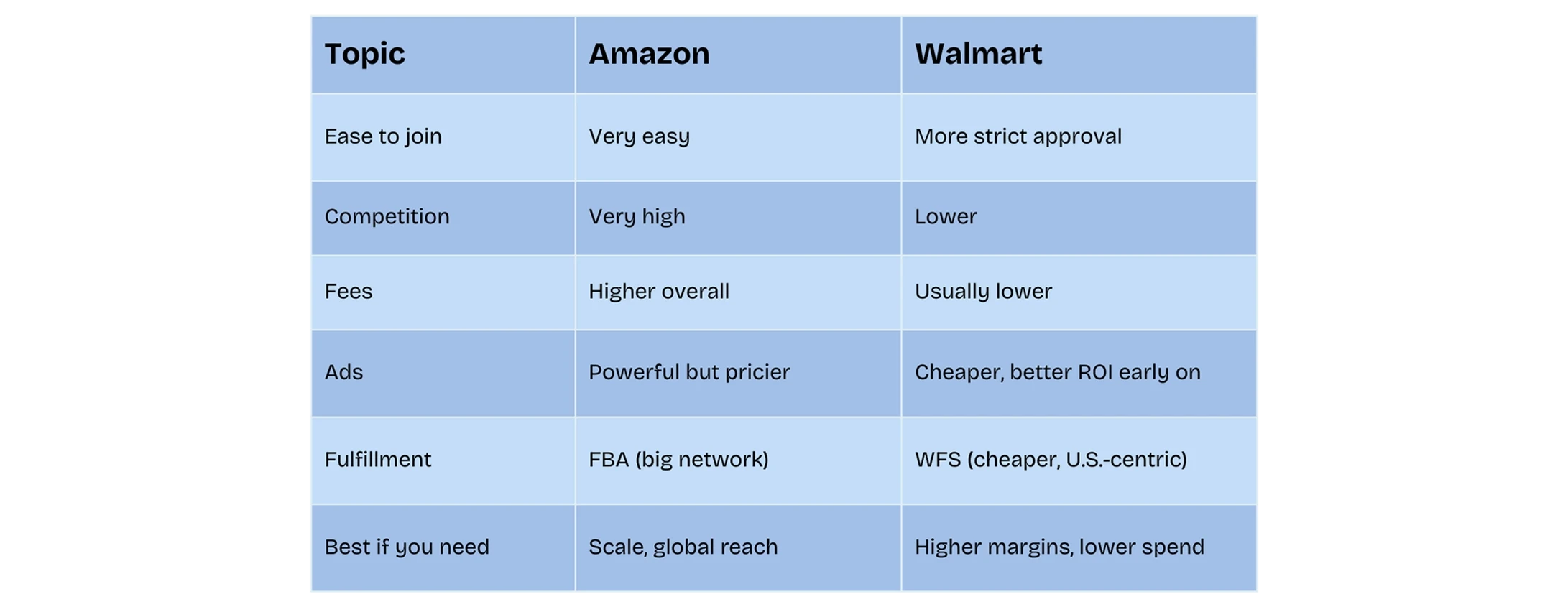

At a Glance: Main Differences

What Sellers Care About?

Fees & profit

Sellers want to know how much they keep after fees. Walmart usually charges lower referral fees and doesn’t force a monthly subscription, while Amazon has multiple fees (referral + FBA (Fulfillment by Amazon) + storage + subscription). That affects your profit from day one.

In many fee breakdowns for sellers, even a $100–$200 difference per order can completely change profitability. In several cases, sellers who were losing money on Amazon became profitable after moving the same SKU to Walmart, largely because Walmart Fulfillment Services (WFS) fees were lower.

Competition & visibility

Amazon has many sellers fighting for the same keywords. That means you may need to spend on ads to rank. Walmart has fewer sellers in many categories, so you can get visibility faster without burning your ad budget.

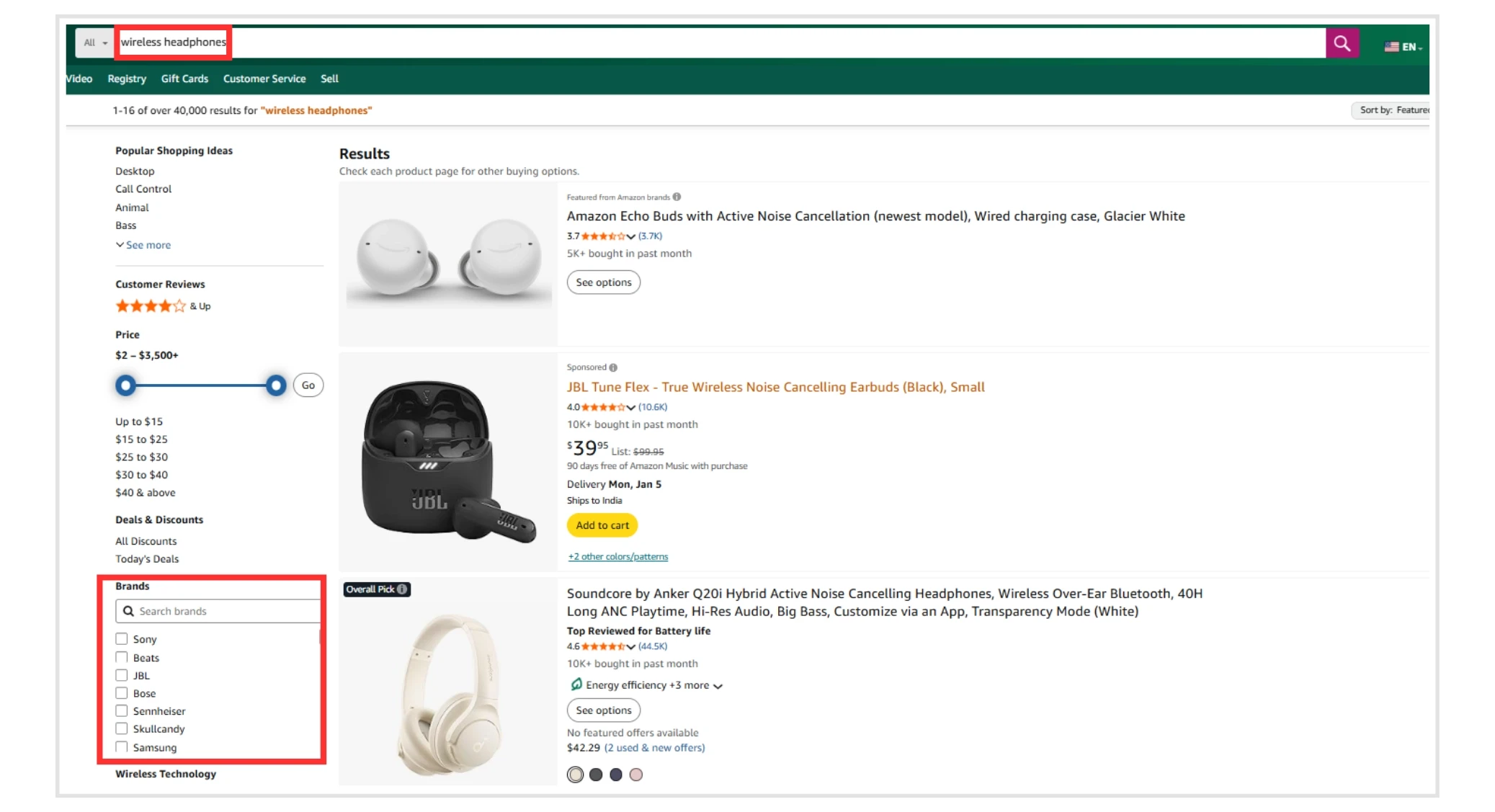

How the Marketplaces Show Products?

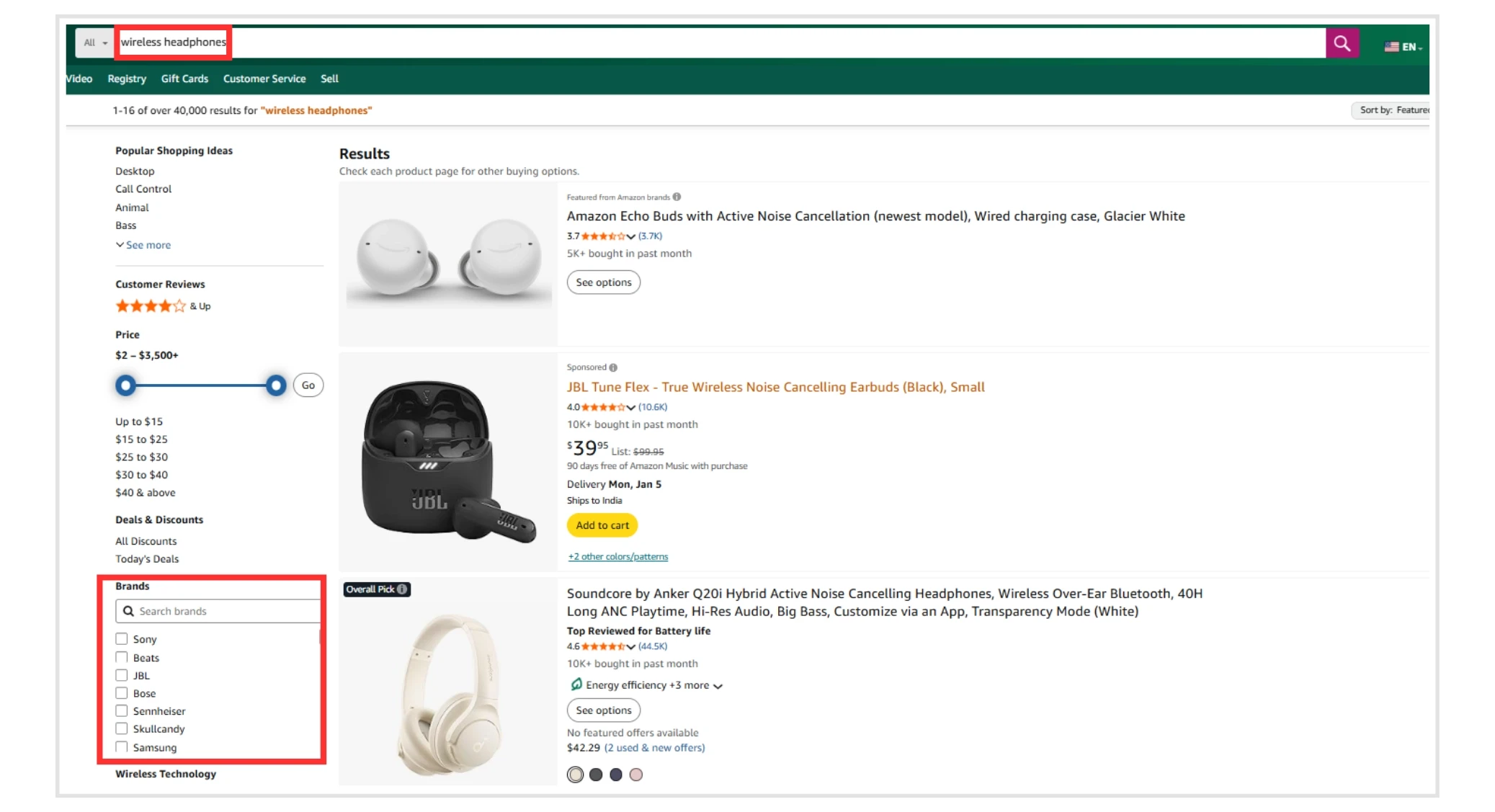

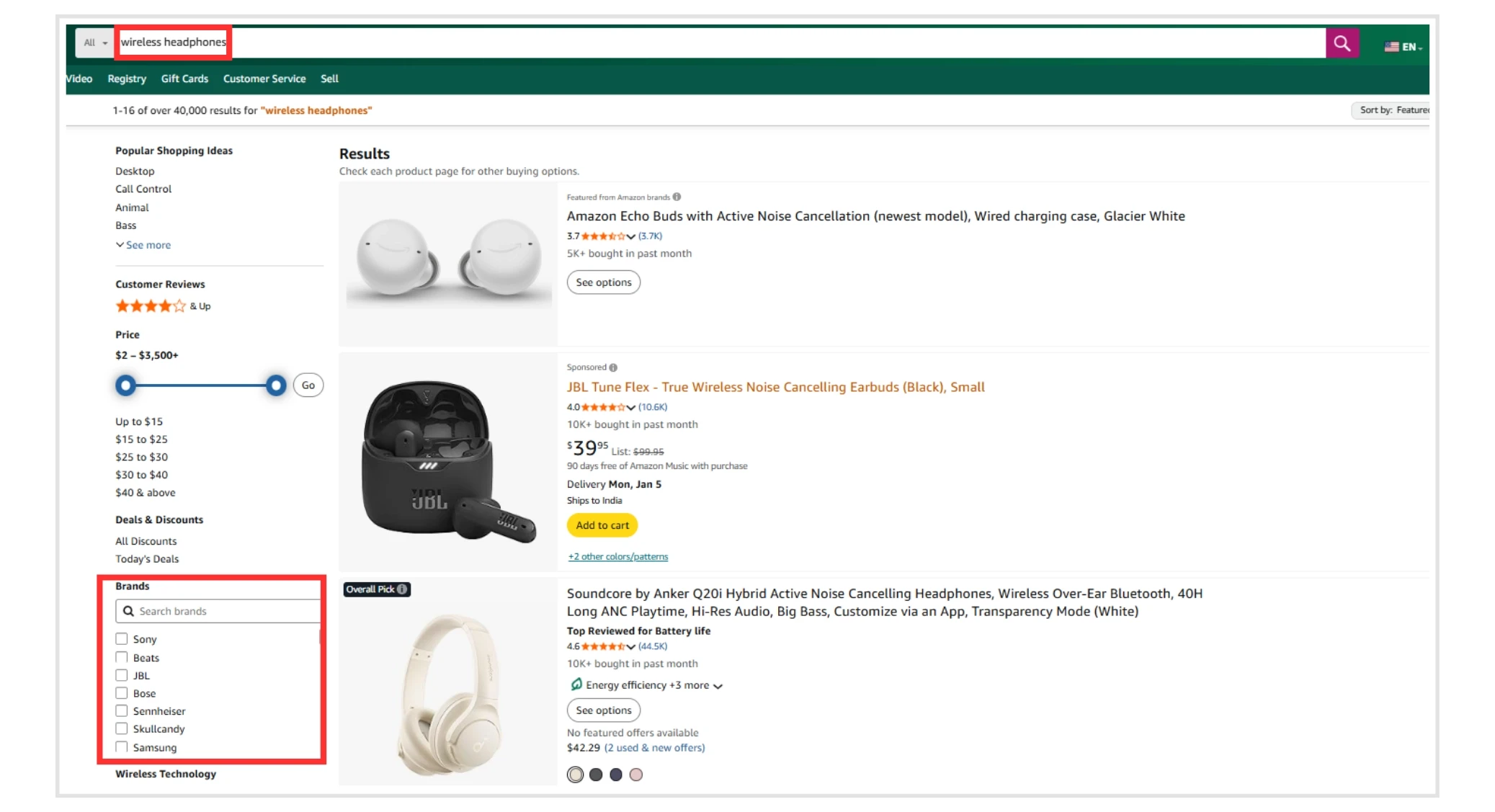

Amazon’s search system

Amazon’s search is built to sell — it looks at keywords, how well your product converts, recent sales, price, fulfillment method (FBA helps), reviews, and stock. If your product doesn’t sell, it won’t rank. That’s why ads are often needed to kickstart sales. Learn more about how Amazon’s ranking works here.

Walmart’s ranking

Walmart focuses on price, product availability, fast shipping, and seller performance. Because there are fewer sellers, good listings with right price + WFS can move up quickly.

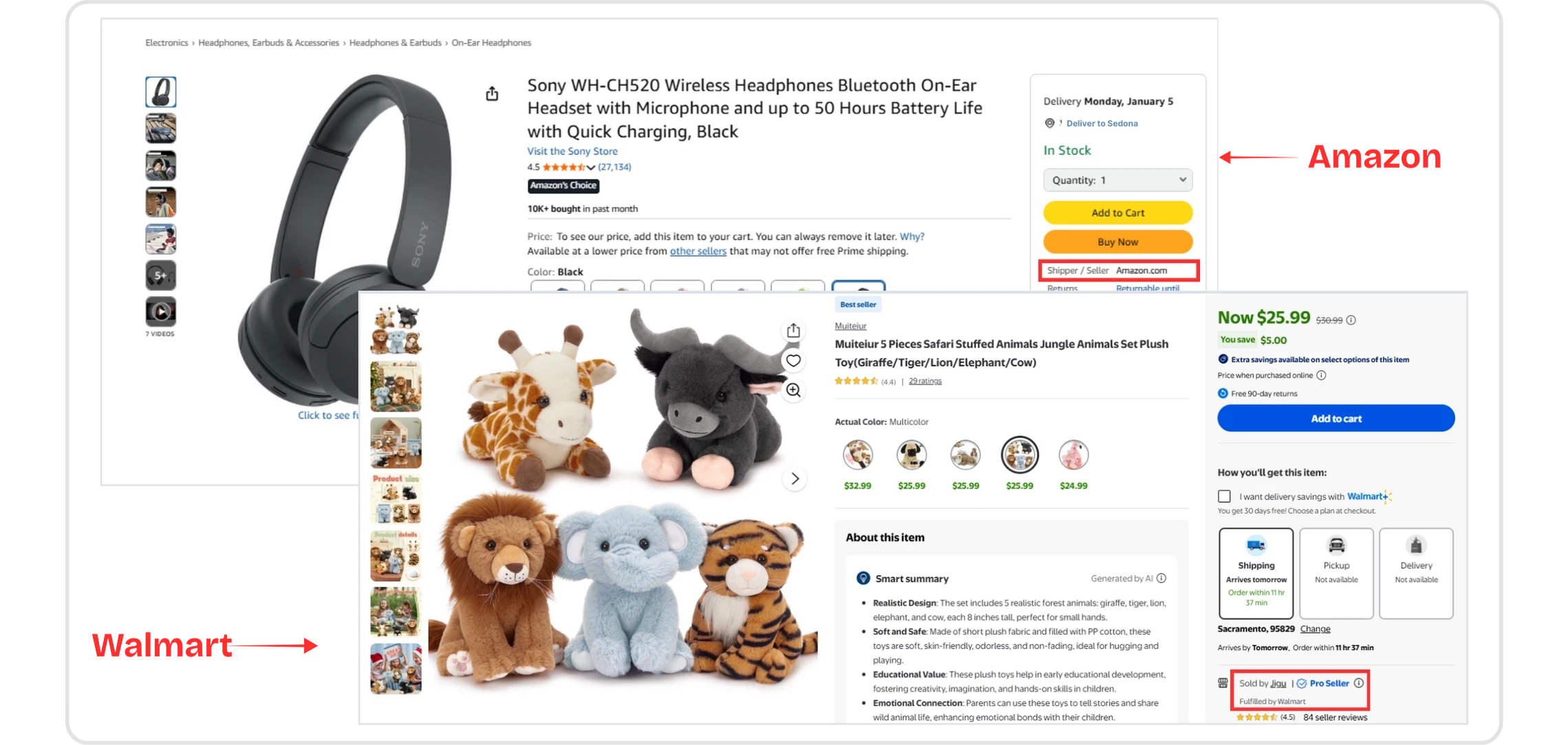

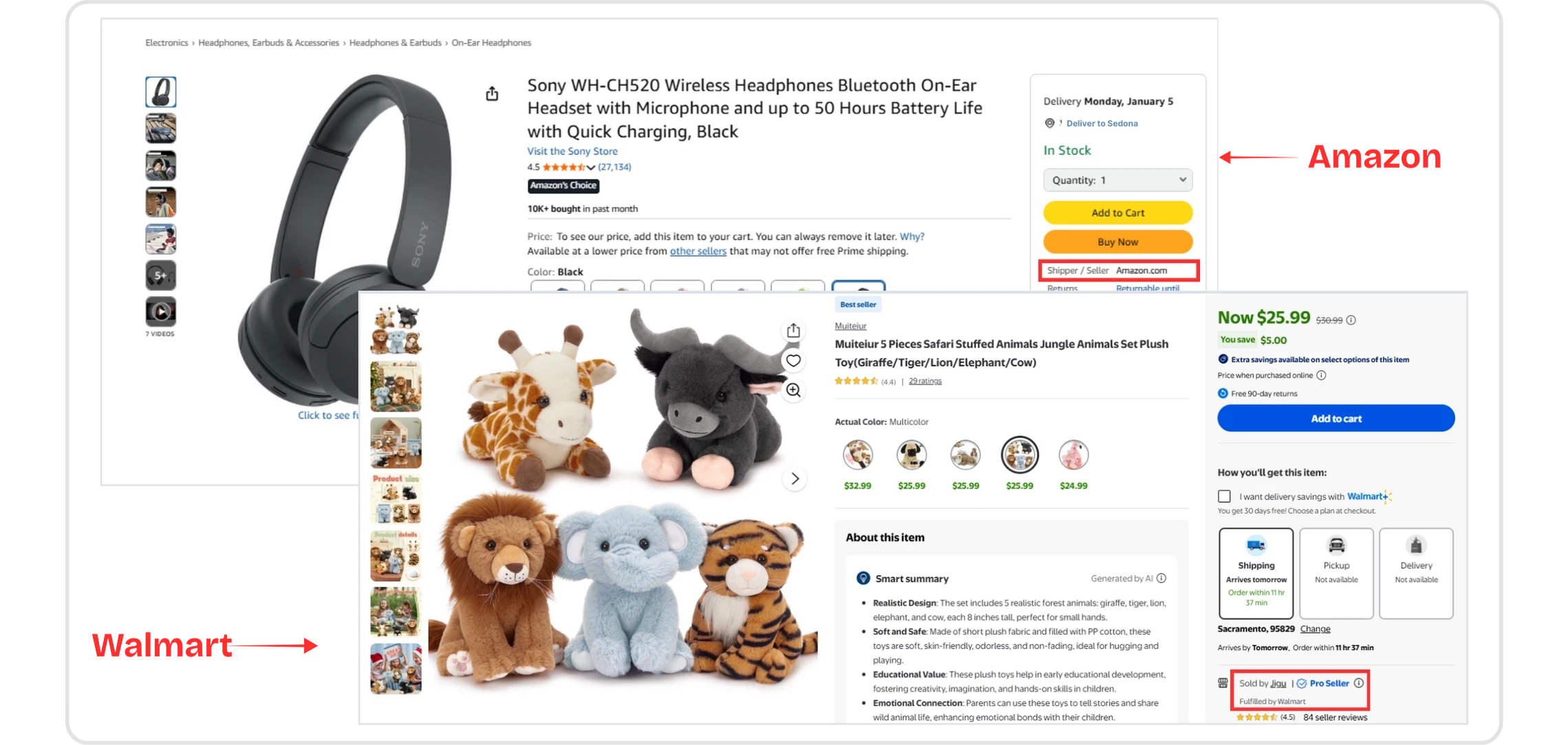

Buy Box basics

Buy Box = where shoppers click Add to cart. Amazon’s Buy Box is fiercely competitive and depends on price, fulfillment, and seller health. Walmart’s Buy Box is easier to capture because fewer sellers compete on each SKU (Stock Keeping Unit).

Fulfillment: FBA vs WFS

FBA (Fulfillment by Amazon): Great reach and customer trust. More fees and more rules (storage/surcharges).

WFS (Walmart Fulfillment Services): Cheaper per unit in many cases, good 2-day delivery benefits, and fewer extra fees.

If your product is low margin, WFS often keeps profits healthier. If you want international scale and won’t mind costs, FBA helps you scale faster.

Advertising

Amazon Ads give big reach through formats like Sponsored Products and DSP (Demand-Side Platform), but CPCs (Cost Per Click) is higher because many sellers bid on the same keywords. You must watch your ACoS (Advertising Cost of Sales) and profit margins closely.

Walmart Connect has lower CPCs and can give higher ROI (Return on Investment) early on, especially for sellers who don’t have a huge ad budget.

Listing & conversion basics sellers must do

5 product bullets that answer “Why buy?”

5–7 high-quality images + 1 short demo video.

Backend search terms (Amazon) and complete attribute fields (Walmart).

Stay competitive with pricing, but safeguard your margins. Any automated pricing should have a firm minimum limit so your price never goes too low.

Get early reviews the right way—request them through Amazon’s or Walmart’s official tools only. Never incentivize or influence reviews. Follow each platform’s review guidelines to avoid penalties.

Risks every seller must know

Account suspensions and listing suppression (both platforms).

Return abuse and refunds.

Inventory limits (FBA) if you don’t manage IPI/stock.

Strict onboarding or documentation requests (Walmart).

Quick seller scenarios

Low-margin, fast-moving goods (e.g., household consumables) → Start with Walmart for better margins.

Niche products with high perceived value → Amazon can reach more relevant buyers.

Small budget for ads → Walmart gives better ROI early.

Brand that plans global expansion → Amazon has more options to scale.

Final Thoughts

Choosing between Amazon and Walmart isn’t about which marketplace is “better”; it’s about which one fits your product, margins, and growth stage.

If you want healthier margins and lower ad spend, starting with Walmart Marketplace often makes sense. If your goal is high volume, international reach, and stronger brand-building tools, Amazon remains the better option.

The safest approach is to begin where your product performs best based on category fit and unit economics, then expand to the other marketplace once you have a proven SKU, stable operations, and predictable demand.

No matter which platform you choose, focus first on the fundamentals: listing quality, inventory planning, and clear unit economics. These consistently outperform shortcuts, hacks, or quick-win tactics.

To stay profitable and in control, track these metrics weekly:

Sessions

Buy Box percentage

Ad spend (ACoS)

Margin per order

Strong data, not assumptions, is what turns marketplace selling into a scalable business.

Selling online today means choosing the right marketplace as much as choosing the right product. For many sellers, the decision often comes down to two giants: Amazon and Walmart. Both platforms offer massive reach, established trust, and powerful infrastructure—but they operate very differently and suit different types of businesses.

Amazon is known for its global scale, advanced fulfillment network, and intense competition, while Walmart is growing fast with a more selective marketplace, lower competition in many categories, and strong omnichannel presence. Choosing the wrong platform can impact your margins, visibility, and long-term growth.

In this blog, we’ll break down the key differences between Amazon and Walmart from a seller’s perspective, including fees, competition, fulfillment options, audience behavior, and growth potential. By the end, you’ll have a clear understanding of which marketplace aligns best with your business goals and selling strategy.

At a Glance: Main Differences

What Sellers Care About?

Fees & profit

Sellers want to know how much they keep after fees. Walmart usually charges lower referral fees and doesn’t force a monthly subscription, while Amazon has multiple fees (referral + FBA (Fulfillment by Amazon) + storage + subscription). That affects your profit from day one.

In many fee breakdowns for sellers, even a $100–$200 difference per order can completely change profitability. In several cases, sellers who were losing money on Amazon became profitable after moving the same SKU to Walmart, largely because Walmart Fulfillment Services (WFS) fees were lower.

Competition & visibility

Amazon has many sellers fighting for the same keywords. That means you may need to spend on ads to rank. Walmart has fewer sellers in many categories, so you can get visibility faster without burning your ad budget.

How the Marketplaces Show Products?

Amazon’s search system

Amazon’s search is built to sell — it looks at keywords, how well your product converts, recent sales, price, fulfillment method (FBA helps), reviews, and stock. If your product doesn’t sell, it won’t rank. That’s why ads are often needed to kickstart sales. Learn more about how Amazon’s ranking works here.

Walmart’s ranking

Walmart focuses on price, product availability, fast shipping, and seller performance. Because there are fewer sellers, good listings with right price + WFS can move up quickly.

Buy Box basics

Buy Box = where shoppers click Add to cart. Amazon’s Buy Box is fiercely competitive and depends on price, fulfillment, and seller health. Walmart’s Buy Box is easier to capture because fewer sellers compete on each SKU (Stock Keeping Unit).

Fulfillment: FBA vs WFS

FBA (Fulfillment by Amazon): Great reach and customer trust. More fees and more rules (storage/surcharges).

WFS (Walmart Fulfillment Services): Cheaper per unit in many cases, good 2-day delivery benefits, and fewer extra fees.

If your product is low margin, WFS often keeps profits healthier. If you want international scale and won’t mind costs, FBA helps you scale faster.

Advertising

Amazon Ads give big reach through formats like Sponsored Products and DSP (Demand-Side Platform), but CPCs (Cost Per Click) is higher because many sellers bid on the same keywords. You must watch your ACoS (Advertising Cost of Sales) and profit margins closely.

Walmart Connect has lower CPCs and can give higher ROI (Return on Investment) early on, especially for sellers who don’t have a huge ad budget.

Listing & conversion basics sellers must do

5 product bullets that answer “Why buy?”

5–7 high-quality images + 1 short demo video.

Backend search terms (Amazon) and complete attribute fields (Walmart).

Stay competitive with pricing, but safeguard your margins. Any automated pricing should have a firm minimum limit so your price never goes too low.

Get early reviews the right way—request them through Amazon’s or Walmart’s official tools only. Never incentivize or influence reviews. Follow each platform’s review guidelines to avoid penalties.

Risks every seller must know

Account suspensions and listing suppression (both platforms).

Return abuse and refunds.

Inventory limits (FBA) if you don’t manage IPI/stock.

Strict onboarding or documentation requests (Walmart).

Quick seller scenarios

Low-margin, fast-moving goods (e.g., household consumables) → Start with Walmart for better margins.

Niche products with high perceived value → Amazon can reach more relevant buyers.

Small budget for ads → Walmart gives better ROI early.

Brand that plans global expansion → Amazon has more options to scale.

Final Thoughts

Choosing between Amazon and Walmart isn’t about which marketplace is “better”; it’s about which one fits your product, margins, and growth stage.

If you want healthier margins and lower ad spend, starting with Walmart Marketplace often makes sense. If your goal is high volume, international reach, and stronger brand-building tools, Amazon remains the better option.

The safest approach is to begin where your product performs best based on category fit and unit economics, then expand to the other marketplace once you have a proven SKU, stable operations, and predictable demand.

No matter which platform you choose, focus first on the fundamentals: listing quality, inventory planning, and clear unit economics. These consistently outperform shortcuts, hacks, or quick-win tactics.

To stay profitable and in control, track these metrics weekly:

Sessions

Buy Box percentage

Ad spend (ACoS)

Margin per order

Strong data, not assumptions, is what turns marketplace selling into a scalable business.

Selling online today means choosing the right marketplace as much as choosing the right product. For many sellers, the decision often comes down to two giants: Amazon and Walmart. Both platforms offer massive reach, established trust, and powerful infrastructure—but they operate very differently and suit different types of businesses.

Amazon is known for its global scale, advanced fulfillment network, and intense competition, while Walmart is growing fast with a more selective marketplace, lower competition in many categories, and strong omnichannel presence. Choosing the wrong platform can impact your margins, visibility, and long-term growth.

In this blog, we’ll break down the key differences between Amazon and Walmart from a seller’s perspective, including fees, competition, fulfillment options, audience behavior, and growth potential. By the end, you’ll have a clear understanding of which marketplace aligns best with your business goals and selling strategy.

At a Glance: Main Differences

What Sellers Care About?

Fees & profit

Sellers want to know how much they keep after fees. Walmart usually charges lower referral fees and doesn’t force a monthly subscription, while Amazon has multiple fees (referral + FBA (Fulfillment by Amazon) + storage + subscription). That affects your profit from day one.

In many fee breakdowns for sellers, even a $100–$200 difference per order can completely change profitability. In several cases, sellers who were losing money on Amazon became profitable after moving the same SKU to Walmart, largely because Walmart Fulfillment Services (WFS) fees were lower.

Competition & visibility

Amazon has many sellers fighting for the same keywords. That means you may need to spend on ads to rank. Walmart has fewer sellers in many categories, so you can get visibility faster without burning your ad budget.

How the Marketplaces Show Products?

Amazon’s search system

Amazon’s search is built to sell — it looks at keywords, how well your product converts, recent sales, price, fulfillment method (FBA helps), reviews, and stock. If your product doesn’t sell, it won’t rank. That’s why ads are often needed to kickstart sales. Learn more about how Amazon’s ranking works here.

Walmart’s ranking

Walmart focuses on price, product availability, fast shipping, and seller performance. Because there are fewer sellers, good listings with right price + WFS can move up quickly.

Buy Box basics

Buy Box = where shoppers click Add to cart. Amazon’s Buy Box is fiercely competitive and depends on price, fulfillment, and seller health. Walmart’s Buy Box is easier to capture because fewer sellers compete on each SKU (Stock Keeping Unit).

Fulfillment: FBA vs WFS

FBA (Fulfillment by Amazon): Great reach and customer trust. More fees and more rules (storage/surcharges).

WFS (Walmart Fulfillment Services): Cheaper per unit in many cases, good 2-day delivery benefits, and fewer extra fees.

If your product is low margin, WFS often keeps profits healthier. If you want international scale and won’t mind costs, FBA helps you scale faster.

Advertising

Amazon Ads give big reach through formats like Sponsored Products and DSP (Demand-Side Platform), but CPCs (Cost Per Click) is higher because many sellers bid on the same keywords. You must watch your ACoS (Advertising Cost of Sales) and profit margins closely.

Walmart Connect has lower CPCs and can give higher ROI (Return on Investment) early on, especially for sellers who don’t have a huge ad budget.

Listing & conversion basics sellers must do

5 product bullets that answer “Why buy?”

5–7 high-quality images + 1 short demo video.

Backend search terms (Amazon) and complete attribute fields (Walmart).

Stay competitive with pricing, but safeguard your margins. Any automated pricing should have a firm minimum limit so your price never goes too low.

Get early reviews the right way—request them through Amazon’s or Walmart’s official tools only. Never incentivize or influence reviews. Follow each platform’s review guidelines to avoid penalties.

Risks every seller must know

Account suspensions and listing suppression (both platforms).

Return abuse and refunds.

Inventory limits (FBA) if you don’t manage IPI/stock.

Strict onboarding or documentation requests (Walmart).

Quick seller scenarios

Low-margin, fast-moving goods (e.g., household consumables) → Start with Walmart for better margins.

Niche products with high perceived value → Amazon can reach more relevant buyers.

Small budget for ads → Walmart gives better ROI early.

Brand that plans global expansion → Amazon has more options to scale.

Final Thoughts

Choosing between Amazon and Walmart isn’t about which marketplace is “better”; it’s about which one fits your product, margins, and growth stage.

If you want healthier margins and lower ad spend, starting with Walmart Marketplace often makes sense. If your goal is high volume, international reach, and stronger brand-building tools, Amazon remains the better option.

The safest approach is to begin where your product performs best based on category fit and unit economics, then expand to the other marketplace once you have a proven SKU, stable operations, and predictable demand.

No matter which platform you choose, focus first on the fundamentals: listing quality, inventory planning, and clear unit economics. These consistently outperform shortcuts, hacks, or quick-win tactics.

To stay profitable and in control, track these metrics weekly:

Sessions

Buy Box percentage

Ad spend (ACoS)

Margin per order

Strong data, not assumptions, is what turns marketplace selling into a scalable business.

Kamlesh Deora

, Chief Executive Officer

Kamlesh is a web expert at Coozmoo Digital Solutions with 8+ years of experience in usability-focused and comparison-driven web design. He has worked across 340+ website and digital experience projects, helping brands simplify complex choices through clear structure and intuitive designs.

Need growth?

Today!

Latest Blogs

Don’t miss our revenue growth tips!

Get expert marketing tips—straight to your inbox, like thousands of happy clients.

Don’t miss our revenue growth tips!

Don’t miss our revenue growth tips!

Don’t miss our revenue growth tips!

Get expert marketing tips—straight to your inbox, like thousands of happy clients.

Don’t miss our revenue growth tips!

Get expert marketing tips—straight to your inbox, like thousands of happy clients.

Relevant Blogs on Web Design

Relevant Blogs on Web Design

Relevant Blogs on Web Design

Unlock data-driven insights in Web Design—explore our featured blogs and skyrocket your revenue before your competitors do.

Web Design

Web Design

Jan 18, 2026

Jan 18, 2026

12 Min Read

12 Min Read

Using Heatmaps to Improve Your Website’s UX: Best Heatmap Tools 2026

Using Heatmaps to Improve Your Website’s UX: Best Heatmap Tools 2026

Web Design

Web Design

Jan 10, 2026

Jan 10, 2026

10 Min Read

10 Min Read

The Ultimate Guide to Choosing Your E-commerce Platform

The Ultimate Guide to Choosing Your E-commerce Platform

Web Design

Web Design

Jan 5, 2026

Jan 5, 2026

12 Min Read

12 Min Read

What Is Keyword Cannibalization? How It’s Hurting Your Website (And How to Fix It)

What Is Keyword Cannibalization? How It’s Hurting Your Website (And How to Fix It)

Ready to speak with an expert?

Data-Driven Marketing Agency That Elevates ROI

1100+

Websites Designed & Optimized to Convert

$280M+

Client Revenue Driven & Growing Strong

Discover how to skyrocket

your revenue today!

Trusted by 1000+ Owners!

Want to skyrocket revenue?

4.9/5 Ratings!

Want to skyrocket revenue?

4.9/5 Ratings!

Ready to speak with an expert?

Data-Driven Marketing Agency That Elevates ROI

1100+

Websites Designed & Optimized to Convert

$280M+

Client Revenue Driven & Growing Strong

Discover how to skyrocket

your revenue today!

Trusted by 1000+ Owners!

Ready to speak with an expert?

Data-Driven Marketing Agency That Elevates ROI

1100+

Websites Designed & Optimized to Convert

$280M+

Client Revenue Driven & Growing Strong

Want to skyrocket

revenue?

Trusted by 1000+ Owners!